The insurance sector is entering a transformative phase as telematics technology matures. Vehicles today are no longer just modes of transport—they’re intelligent systems equipped with sophisticated sensors and real-time data capabilities. It's estimated that by 2030, software and electronic components will contribute to nearly half of a vehicle’s total worth. This technological evolution is paving the way for insurers to move beyond traditional models and embrace more dynamic, personalized solutions.

Telematics 2.0 signals the arrival of a smarter era. By integrating AI and IoT, insurers can now offer real-time pricing, proactive vehicle maintenance, and refined risk management. No longer limited to tracking mileage, telematics is reshaping the foundation of how insurance is designed, delivered, and experienced.

Evolving from Raw Data to Real-Time Understanding

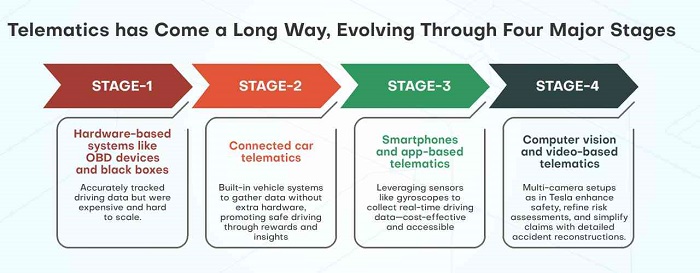

The earliest iterations of telematics focused primarily on collecting straightforward data points—how far and how fast someone drove, and how often they braked hard. But today’s systems dive much deeper. Telematics 2.0 emphasizes situational awareness—focusing not just on how people drive, but also where, when, and under what conditions.

Digitization is only as valuable as the insights it offers. Simply gathering information isn’t enough. What’s needed is actionable intelligence that improves daily experiences for both drivers and insurers. By factoring in environmental inputs such as weather, road hazards, and traffic congestion, this next-gen telematics can drive more accurate and dynamic risk modeling.

This evolution is fueling market expansion. According to Allied Market Research, the global telematics insurance industry is expected to grow at a rate of 19.5% annually between 2021 and 2028, driven largely by the demand for deeper, context-rich data.

Predictive Maintenance: Unlocking a New Insurance Offering

Predictive maintenance, while widely used in commercial fleets, is now making its way into consumer insurance. With advanced diagnostics available from connected vehicles, insurers can take a proactive role in helping drivers avoid breakdowns and accidents.

Munich Re is at the forefront of this shift. Their modular telematics insurance—offered as either standalone apps or integrated SDKs—enable insurers to access detailed diagnostics, customize user interfaces, and deliver predictive alerts. This not only prevents costly repairs but also reduces the likelihood of claims.

By combining vehicle data with machine learning, insurers are beginning to anticipate mechanical issues before they arise. Companies like State Farm are incorporating this strategy, offering drivers personalized maintenance alerts based on real-time usage and vehicle performance. Some insurers are also teaming up with automakers and connected car platforms to dig even deeper into diagnostics and enhance underwriting models.

These tools don’t just protect drivers—they improve business outcomes. Predictive maintenance features can lead to 30% more accurate risk assessments and help lower incident rates by up to 20%.

Driving Behavior Change Through Engagement and Incentives

Traditional usage-based insurance (UBI) plans reward good driving with lower premiums, but Telematics 2.0 takes things further. By weaving behavioral science into the experience, insurers are actively encouraging safer driving habits.

Gamification—using techniques like point systems, rankings, and rewards—can nudge drivers toward more responsible behavior. This increases both road safety and policyholder loyalty. A University of Guelph study found that gamified insurance programs, especially among younger drivers, significantly boost participation and engagement.

Root Insurance is already putting this into practice, offering telematics-powered pricing models that reward safe drivers with discounts. This has led to a 15% drop in claims. Similarly, Cambridge Mobile Telematics has reported up to a 40% decrease in accident risk when behavioral feedback and gamified experiences are used in conjunction.

Tapping into Ecosystem Value: Partnerships That Go Beyond Insurance

Another promising development is how telematics insurance data can fuel collaborations across industries. From smart city initiatives to consumer partnerships, insurers are starting to use telematics as a bridge into wider ecosystems.

Sharing anonymized driving data with urban planners, for example, can help cities improve road safety and traffic flow. Audi’s Traffic Light Information system demonstrates how vehicle data can integrate with infrastructure to reduce congestion.

Retail partnerships offer another avenue for innovation. Insurers like Progressive are leveraging driving data to create joint programs with retailers, offering incentives and tailored offers based on driving routes and behavior. These types of collaborations turn telematics from a back-end tool into a customer-facing benefit.Managing the Data Surge with AI

With vehicles generating massive amounts of information every day, the ability to process and interpret this data is crucial. Artificial intelligence and machine learning play a central role in turning raw inputs into predictive insights.

By analyzing patterns in driver behavior and environmental conditions, AI-driven models help insurers make smarter decisions in real time. This can accelerate claims handling, detect potential fraud, and flag high-risk driving behavior before it results in an incident.

Looking Ahead: Trends Shaping the Future of Telematics

-

Connected Cars & 5G Networks: The growth of 5G and connected vehicles will enhance real-time data sharing, enabling insurers to adjust policies on the fly and provide immediate feedback to drivers.

-

Seamless Embedded Insurance: Insurers are embedding coverage options directly into the car-buying experience, providing more personalized policies at the point of sale.

-

Eco-Tracking & Sustainability: Future telematics platforms are expected to track vehicle emissions and promote environmentally responsible driving, aligning with global sustainability targets.

Conclusion

Telematics 2.0 is redefining the insurance landscape. By merging AI, contextual data, and connected technologies, insurers can provide highly personalized, real-time services that improve safety, reduce costs, and build stronger customer relationships. The insurers that embrace this next wave of innovation will be best positioned to lead in an increasingly digital, data-driven future.